Login to Td Bank Business Direct Account:

The Toronto-Dominion Bank participates in giving monetary items and administrations. It works through the accompanying sections: Canadian Retail, U.S. Retail, and Wholesale Banking. The Canadian Retail portion offers different monetary items and administrations, just as Internet, phone, and versatile financial administrations.

The U.S. Retail, corporate financial items fragment gives retail and business banking administrations, just as riches the executives administrations in the United States. The Wholesale Banking section gives capital business sectors, venture banking, and speculation needs to governments, organizations, and establishments in monetary business sectors.

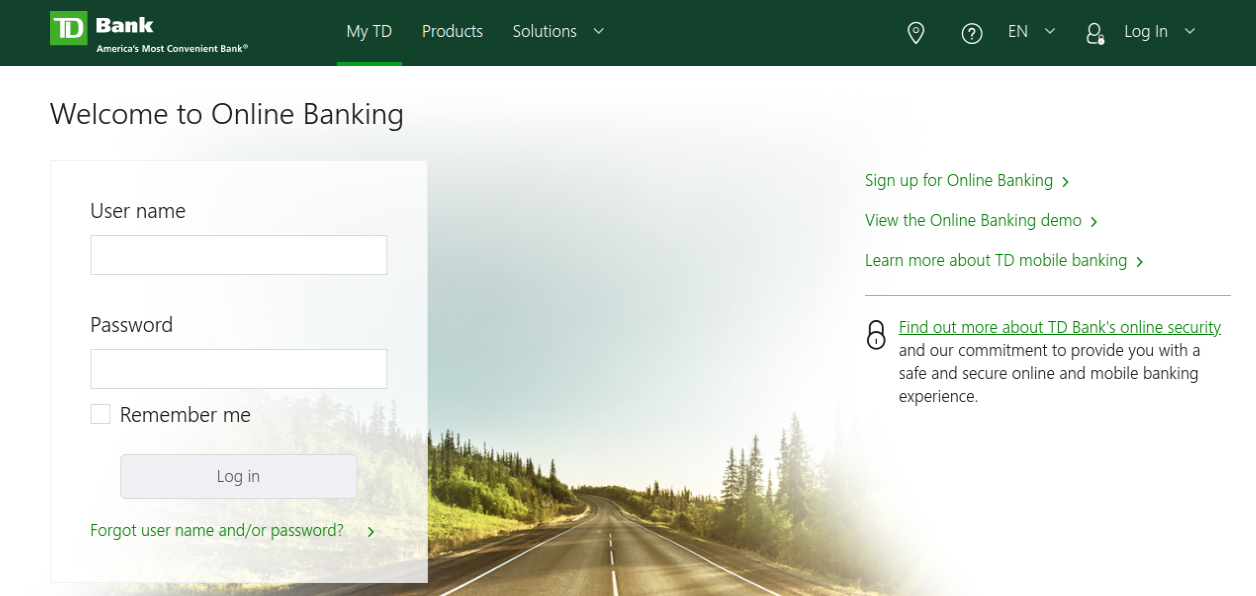

Td Bank Business Direct Login:

To login open the page, onlinebanking.tdbank.com

- As the page opens, at the center, provide,

- The username, following by the password, click on, ‘Login’ button.

Note: You can also login following this link, www.tdbank.com/businessdirect.

How to reset Td Bank Business Direct login credentials:

To reset the information, open the page, onlinebanking.tdbank.com

- After the page appears, under the login spaces tap on, ‘Forgot username and or/password’ button.

- You will be forwarded to the next screen, for username, enter the SSN, select your account type, click on, ‘Submit’ button.

- For password recovery, provide the username, SSN or TIN, and their last 4 numbers. Hit on, ‘Continue’ button.

- For both info, enter the SSN, select your account type, click on, ‘Submit’ button.

How to sign up for Td Bank Business Direct account:

To sign up open the page, onlinebanking.tdbank.com

- As the page opens, at the center, click on, ‘Sign up for online banking’ button.

- You have to choose from, personal, Small business, personal and small business accounts.

- After you select it, you have to follow the prompts.

Also Read : Access to All in Credit Center Account

Things to know about TD credit card:

- Additional money back classes are foodie-accommodating: Earn 3% money back when you eat out and 2% money back at supermarkets. All different buys gain 1% money back. Suppose you go through $500 every month at eateries and $500 per month at supermarkets. Counting the sign-up reward, you’ll win $450 in real money back for the year.

- Recover for more than money back: As much as the TD Cash Credit Card centers around money back, you really have an assortment of decisions when reclaiming focuses. Notwithstanding getting money back as an announcement credit or direct store into your financial balance, you can likewise recover focuses for gift vouchers, travel, and product.

- Focuses are worth 1 penny: each when you reclaim them for money back, and in any event 1 penny each when you recover for movement or gift vouchers. Point esteems likewise fluctuate when you recover for stock. In the event that you pick money back, you should reclaim at least 2,500 focuses.

- There’s a respectable introduction APR offer on balance moves: The card offers an introduction 0% Introductory APR on Balance Transfers for the initial 15 charging cycles after Account Opening, and afterward the continuous APR of 17.99%, 12.99%, or 22.99%, Variable. The remaining balance move expense is on the last place. This makes the TD Cash Credit Card a strong decision for anybody requiring some an ideal opportunity to settle a Visa balance.

- It makes a decent partner in crime: If you need a charge card that can deal with global travel, search for two things: overall acknowledgment at abroad vendors and no unfamiliar exchange expenses. Between its 0% unfamiliar exchange charge and the way that it’s a Visa card, the TD Cash Credit Card breezes through the two assessments.

TD bank Customer service:

To get further help call on, 1-888-561-8861 (Toll-free).

Reference link: