Evine Credit Card Login:

Now Evine has become ShopHQ. ShopHQ Credit Card might be the best option for you to take. This will help you build your credit score and enjoy rewards for frequent purchases, and with this guide, you can understand what credit conditions apply and what rewards are available. This Card comes with a variety of exclusive offers and savings. You will receive a $10 statement credit if you make your first purchase within the first 30 days of account opening.

Benefits of Evine Credit Card:

- You will get a signup bonus of $10 if you spend $0.

- This card has a variable purchase APR of 27.99%.

- This card gives you the benefits of a credit card, but you don’t have to pay an annual fee for the privilege.

- You will need a credit score above 650.

- Contact their customer service number so you can have issues addressed and resolved

- This has been designed for Evine shoppers

- You have to note your ID is case-sensitive and may differ from your Evine.com User ID

- The Synchrony Bank Privacy Policy governs the use of the Evine Credit Card

- This is A BIG MUST for Evine fanboys.

Pros and cons of Evine Credit Card:

Pros

- You don’t need to pay an annual fee.

- You can freely access your credit score.

- Evine Credit Card reports to multiple credit bureaus.

Cons

- You need to pay higher than average purchase APRs.

- You will not get rewards or cashback.

- This card does not include any credit card benefits.

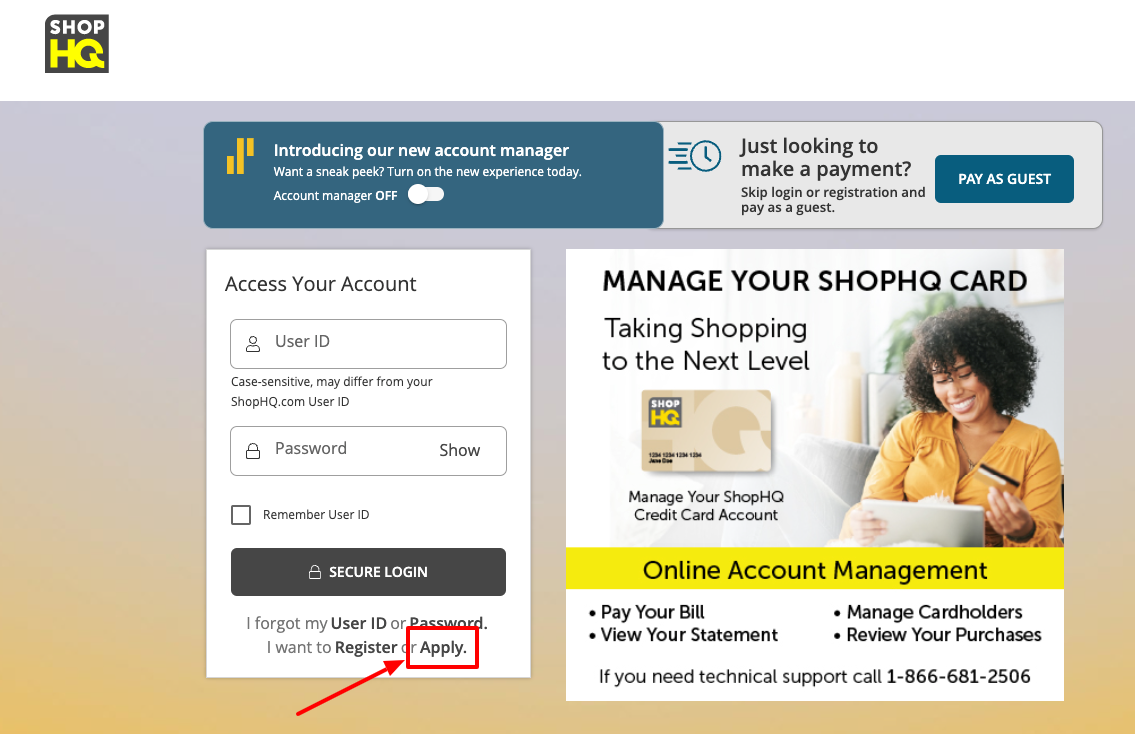

Evine Credit Card Apply Online:

Apply for your ShopHQ credit card through the following steps.

- Visit evinecard.com

- Then click on Apply button under the card.

- On the next page fill up a form.

- Enter your details as directed.

- Submit your form.

Eligibility for Applying for Evine Credit Card:

- Applicants must have a ShopHQ credit card online account.

- A valid phone number is required.

- The age should be 18 years of age.

- A good credit score is required to get this credit card.

Fees and Charges:

- The annual percentage rate (APR): The APR for purchases is the prime rate plus 23.74%.

- Minimum interest charge: If you are charged interest, the charge will be no less than $2.00.

- Cash advance fees: 4% of the advance amount or $10, whichever amount is greater

- Late fee: $29 to $40

- Grace period: 23 days.

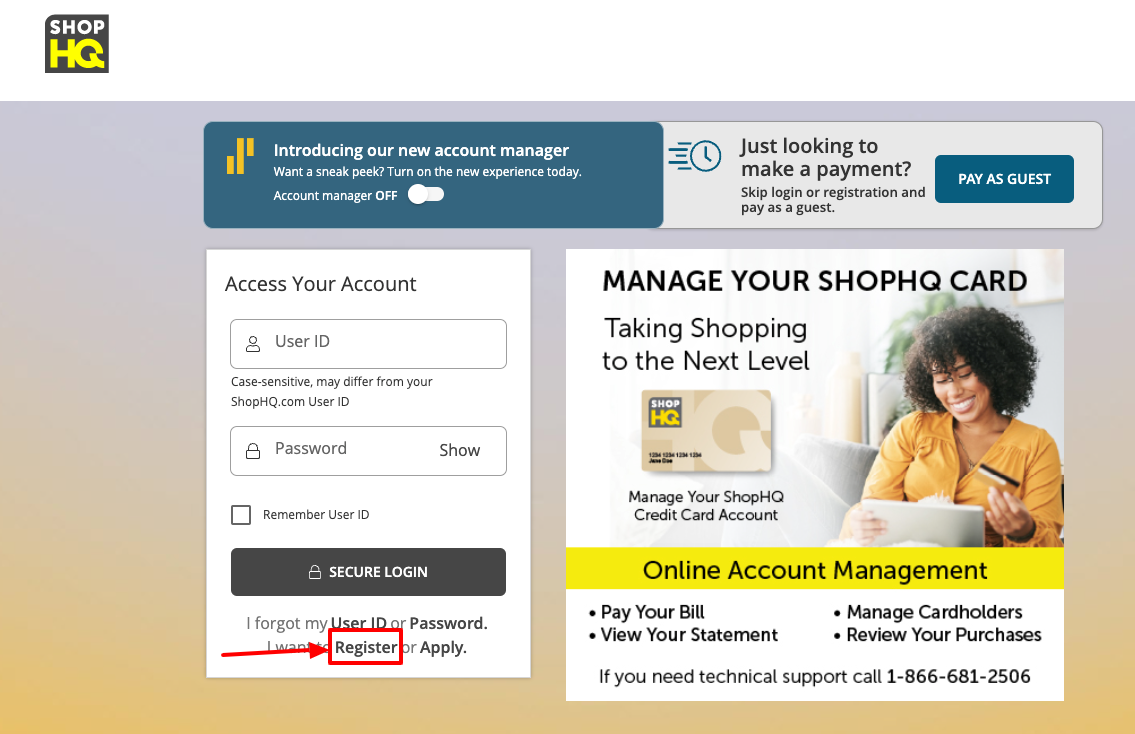

Evine Credit Card Register:

- First, go to the evine credit card login page at evinecard.com

- Then click on the Register link under the secure login button.

- After Enter your Account Number and Zip Code.

- Then click on the Continue button.

Evine Credit Card Login Guide Online:

- First, go through the official website at evinecard.com

- Type the user name and password in the given place.

- Finally, tap on ‘Secure Login’ to continue.

evine credit card Password Recovery:

If you’ve forgotten any of your login details then don’t need to worry about it. You need to follow these simple steps for resetting your user’s name or password.

- Open the official website at evinecard.com

- Click on the sign-in button and find the “Forgot User ID or Password?” link.

- Enter required details and follow the on-screen instructions there.

- Finally, tap on the “Continue” button.

- Reset your username or password easily.

Evine Credit Card Bill Payment:

You can use the ShopHQ website or mobile app for making a ShopHQ card payment online. You can also pay by phone, by mail, or at a branch. There you can also review your statements and account balance, can set up payment notifications, and manage your card. There you can also choose how much to pay when to pay it, and where the payment is coming from.

Online bill payment:

You’ll first need to set up online access and then log in through the site or app and set up a payment account like your savings or checking account.

- First Log in to your ShopHQ Card account online at evinecard.com

- Select “Payments” from the main navigation menu.

- There select “Make a Payment.” Option.

- You have to choose the “Add a bank account” option there and provide your account details.

- Then select a payment amount from the available options there and pay the minimum amount due, the full statement balance, the current statement balance, or enter another amount of your choosing.

- Select a payment date, or simply select “pay now” to send your payment on the earliest date available.

- Then choose a payment account from your available bank accounts.

- After that tap on “Review and Verify” to confirm the details of your payment.

- Finally, tap on the “Pay now” to make your payment.

- You can set a payment date, amount, and payment account to be used for each automatic payment by selecting a Repeat payment option.

Also Read:

Step by Step guide to Activate Cabela’s Club Card Online

How to Activate your Venmo Credit Card Account

Application process for BBVA ClearPoints Card Online

Set Autopay:

- First, you will need to sign in to your account online.

- Then click on ‘Pay Bill’ in the top menu bar.

- After that tap on the ‘AutoPay’ option and then click on ‘Set Up’.

- Choose an account from the ‘Pay To’ selector if you have more than one account.

- Then choose your payment account from the ‘Pay From’ selector.

- After that select whether you would like to pay your Minimum Payment or Last Statement Balance.

- Then click on the continue button.

- Finally, you need to verify the details you selected are correct and click ‘Confirm’ to finish setting up AutoPay.

- You will get a confirmation notice with the start date of your first automatic payment.

- Pay at least your Minimum Payment for that month using a one-time payment to avoid a late fee if you set up AutoPay within 4 days of your Payment Due Date.

Payment through mail:

If you want to use a check or money order but not cash, you can mail your payment into ShopHQ cards. Put your card number on the memo or note field of your money order or check so the company applies it to the right account. Make sure to send it early enough that it will arrive by the due date. Mail it to ShopHQ, PO Box 960009, Orlando, FL 32896-0009.

Lock your ShopHQ credit card:

You can instantly lock and unlock your ShopHQ credit card if lost or misplaced to prevent it from being used for purchases from its mobile app. You just have to follow these few simple steps.

- Open your ShopHQ card official website first evinecard.com

- Log in with your credentials.

- Select the card you want to freeze.

- Then tap on the “Control Your Card” option.

- After that press the “Lock or Unlock this card” option there.

- Change the settings so that your card is in a locked position.

- You can navigate back to the Secure Hold page and unlock your card to use your card again.

Getting Started with Evine Credit Card:

Once you have activated your credit card then follow these steps to start using your credit card and optimize it to avoid fees, simplify your account management and earn rewards on your purchases.

- First download ShopHQ mobile app to simplify your finances, track your rewards, lock your card in case you lose it, and more.

- Set up your digital wallets, including Apple Pay, Google Pay, Samsung Pay, Garmin Pay, Fitbit Pay, etc.

- Then enroll in online banking using your SSN or TIN and your credit card information which will allow you to monitor your accounts, make payments, set up virtual cards, and more.

- Activate your Virtual credit card offered by ShopHQ. This will keep your real card information hidden and secure. add the Eno from ShopHQ extension from your browser and use it during online shopping.

- Set Up your PIN. You will get a personal identification number (PIN) along with your card. If you didn’t receive it or you want to change the old one then you will need to call the number on the back of your card. This PIN can be used in ATM cash withdrawals and for purchases abroad.

Set up your Autopay. After signing in to your ShopHQ online banking account select Pay Bills. Then select Payment options and then tap on the Autopay option. This will help you to pay on time and avoid late payment fees.

Customer Support:

For general concerns, there is the customer support which will help you 24 hours a day, 7 days a week.

You can contact their customer service executives through the following details.

Customer Service:

1-800-676-5523

Hours:

Monday – Friday: 8am-9pm CST

Saturday & Sunday: 9am-5pm CST

Order line: 1-800-474-6762

Automated phone system: 1-800-884-2212

Evine

Attn: Customer Relations

6740 Shady Oak Rd

Eden Prairie, MN 55344

Evine Card/ Mastercard:

1-866-597-1513

Claims Department:

1-888-284-8718

Evine Protection Plan Assistance:

1-877-WARRANTY (1-877-927-7268)

FAQ:

How can you manage your online ShopHQ account?

- You can enroll in Online Banking Service to do all of the following actions with your ShopHQ card and more:

- Make a ShopHQ credit card payment

- Enroll to receive online statements for your ShopHQ card

- View recent transactions

- View previous statements

- View payment history

- View your balance and other important ShopHQ credit info

Does Evine have a credit card?

- Evine Credit Card is a store credit card issued by Synchrony Bank. This card is designed for people with fair credit. The minimum credit score to apply is 650. … Free access to your credit score.

When will you receive your credit card?

- It is a very fast process to get your brand new credit card after applying and approving your credit card. After approving your new ShopHQ credit card and welcome materials containing important ShopHQ card info will be mailed within (3) business days.

How does Evine value pay work?

- It is a payment option that allows purchases on a credit card, PayPal, or ShopHQ Card over a period of several months. At checkout, choose the ValuePay option when available. The first payment, plus applicable shipping/handling and tax will be charged to your payment method when the item(s) is shipped.

How can you check the status of my ShopHQ credit card?

- You can check your ShopHQ Credit Card application status, and call the issuer’s customer service department. You don’t get any online tool to check your application status.

Reference: