How to Apply your Fifth Third Credit Card Online – www.53.com

Fifth Third Credit Card Application:

Fifth Third Bank is one of the largest consumer bank which is headquarters in Cincinnati, Ohio and was founded in the year 1858. I serve the both individual and commercial clients, and has more than 50,000 free ATMs and has over 1,100 branches. This article is for the activation of the Fifth Third bank credit and debit card. Before we get there, we will take a look at the cards offered by the bank.

Few Credit Cards Offered by Fifth Third Bank:

- Fifth Third Preferred Cash/Back Card – this is a rewards credit card, and is offered to the customers who owns an account in the bank. When you make purchases with this card, you will be able to earn 2% cashback every time. You don’t have pay for any annual maintenance, and do not need to worry about the expiry of the points. There is no transfer fee required for the first 12 months which changes to 4% afterwards

- Fifth Third Cash/Back Card – to avail this card, having a bank account is not important, you can have it if you have a fifth third checking or savings account. You will be able to gain 1.67% cashback when you make a purchase, and no capital is required for it. There is no transaction fee for the card, and no fee required for annual maintenance. It also does not require any transfer fee for the first 12 months and changes to 4% afterwards.

- Fifth Third Simply Business Card – this is a sole business credit card, and the ones making purchases with this card will earn 1.67% cashback on spending $1. This card will offer you MasterCard benefits, car rental insurance and so more.

- Fifth Third Bank Secure Card – this card comes with an APR of 23.99% and has annual maintenance of $24. This card requires no credit history, and you need to spend 5% of the amount for the cash advance fee, 4% for balance transfer fee and 3% for transactions in US dollars each time.

Debit cards offered by the Fifth Third Bank:

- Fifth Third Contactless Debit Card – with this card, you can go contact free. All you need to do is that hover or tap the card on the contactless enable terminal, and you will be able to save time during the checkout.

- Fifth Third Affinity Design Debit Card – this card comes with the unique personality that you have, i.e. you can design the cards according to the personality you own. There is no annual fee required for this card.

- Access 360 Reloadable Prepaid Debit Card – this car comes with a charge of $4 every month for the maintenance, and no cash is required to withdraw or transfer funds to the card.

How you can redeem the rewards of Fifth Third bank cards:

They can be redeemed in a number of ways through checks, direct deposits which also includes the auto deposits through the into a checking or savings account, statement credits, charitable donations, airline tickets and fees and many more ways.

Guidelines for the Activation of Fifth Third Bank Credit Card Online:

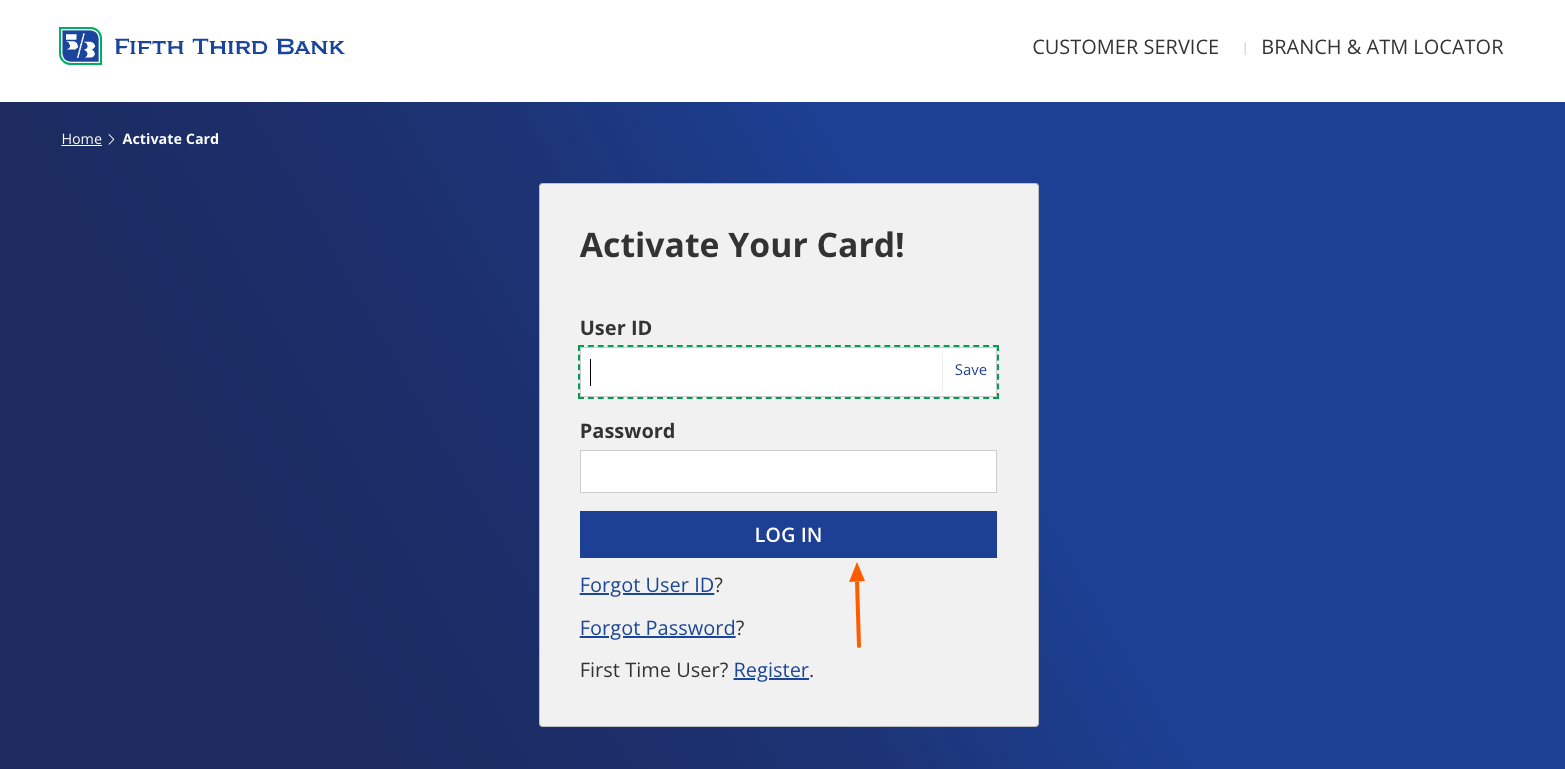

- Launch the web browser of the mobile and go to the official website of the fifth third activation page addressed www.53.com/activate

- Then you have to click on the Activate Card, and you will be directed to the next page.

- Then you have to give the User ID and the password on the fields as asked.

- Then once you have completed filling the credentials, you have to click on the Login button and you will be taken to the next page.

- Then you have to follow the prompts, like giving the details of the card, and once you have completed all the criteria, you card will be activated.

Activation of the Fifth Third debit card over phone:

- First you have to gather all the information regarding the credit card, and keep the card in handy so that you can give the details of the card when asked, and call on the number 800-621-2554.

- Then once the call is answered, you have to follow the prompts so that you can talk to a customer representative.

- Then you have to proceed with the call, and give the details as asked.

- Once the details of the card is verified, it will so be activated and will be ready to use.

Fifth Third Credit Card Application Process Online:

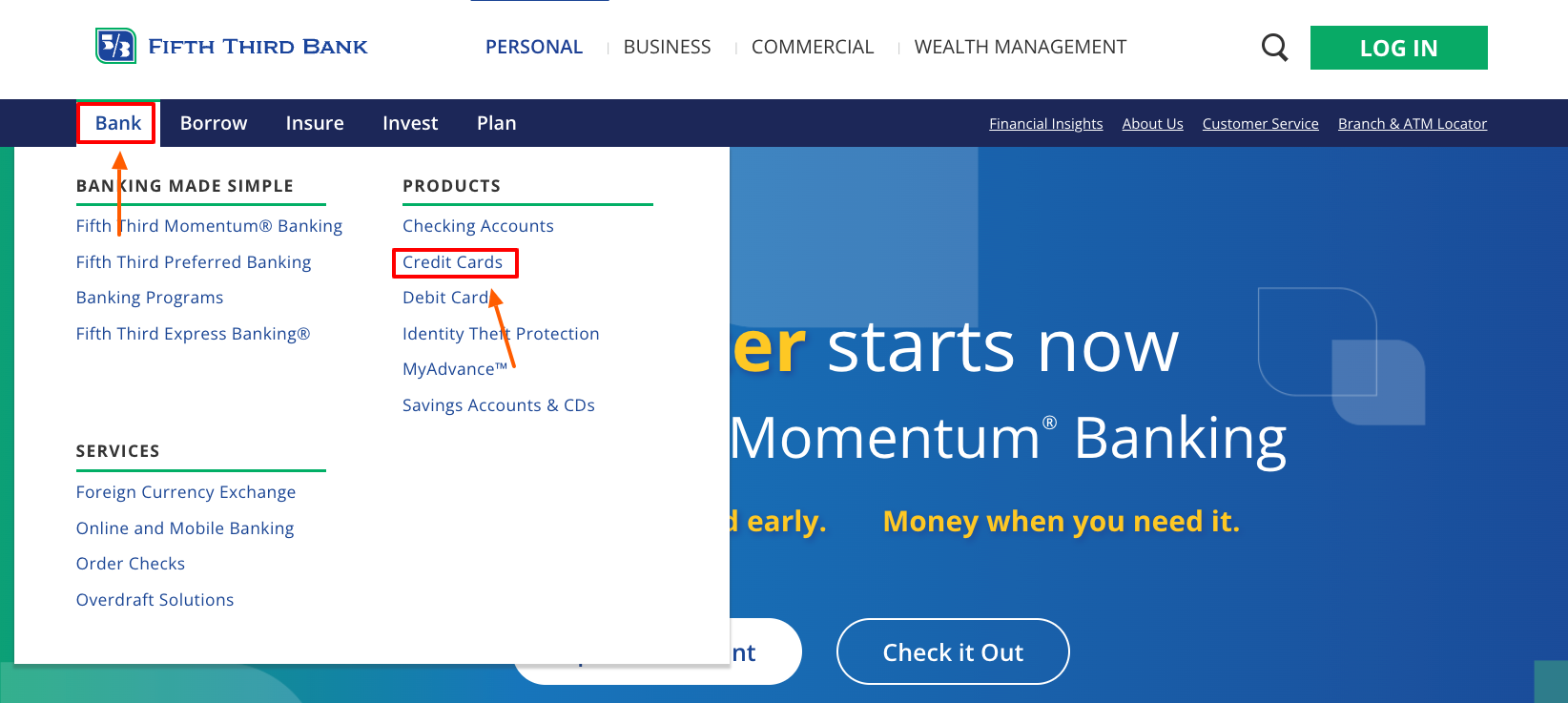

- Launch the web browser and go to the Home page of the bank at www.53.com

- Then you have to click on the Bank option and then from the drop down menu, you have to select the Credit Cards.

- Then select your prefered card and click on APPLY NOW.

- Then you will be directed to next screen, where you have to provide information – are you a bank customer, like userID, password, offer code.

- After you have given the details, you have to hit the Login button, and then you have to follow the prompts to complete the application procedure.

- After your credit eligibility is verified, you are done with your application.

Also Read:

How to Manage your Catherines Credit Card Online

Manage your Fortiva Credit Card Account

Activate and Manage First Bankcard Visa Credit Card

Payment Methods of the Credit Card bills:

- Online – you have to login to the online account or you have to register if you are a first time user, and then you have to click on Make Payment and you can pay the bill.

- Mobile app – you have to download and install the Fifth Third Bank mobile app, and for the ones using the Android have to click on the Transfer and pay, and the ones using the iOS have to tap on Transfer. Then you need to click on Make Payments for the Android users and Make a Payment for the iOS users.

- Phone – you have to make a call on the number 800-972-3030, and provide the information and follow the prompts to make the payment.

- Mail – you have to send a check or a money order to the address provided in the statement. It should be mailed earlier to avoid any late fee.

- Branch – you can visit the branch during the business hours and can pay the bill for your credit card.

Some Frequently Asked Questions (FAQs):

- Q. What to do if my card is stolen and in need for a replacement?

Ans. If your card is stolen, you can call on the number 1-800-782-0279 and talk to their representative.

- Q. What procedure I need to go through if I want to dispute a charge on my debit card?

Ans. if you want any resolve for the dispute on a card, you need to call on the number 1-877-833-6197 that will be available from Monday to Friday 7am to 8 pm (EST) and on Saturday from 8.30 am to 5 pm (EST).

- Q. How will I keep a track of the purchases on my debit card?

Ans. You will have to download the Fifth Third mobile banking app and can handle all your purchases or you may log into account to review you monthly statement.

Conclusions:

This article is about the activation procedure of the Fifth Third bank Credit card and Debit card. If you follow the guidelines, you will be able to activate the card in no time.

Support:

If you are having problem to understand the article or is facing problem with the activation procedure, then you can call on the number 1-800-972-3030 from Monday to Friday 7 am to 8 pm EST and on Saturday from 8.30 am to 5 pm EST and get in touch with the representatives who can assist you with the problem. You can also visit the nearby branch to clarify the problems you are facing.

Reference: