Capital One Credit Card Get My Offer at GetMyOffer.CapitalOne.com

A capital one credit card is ideal for those whose primary spending remains focused on food and experiences. You will get 3% cash back on dining, entertainment, popular streaming services, and grocery stores (which excludes superstores like Walmart and Target). This card also provides 5% cash back on hotels and rental cars booked through Capital One Travel, 8% cash back on Capital One Entertainment purchases and tickets at Vivid Seats, and 1% on all other purchases and a suitcase full of travel benefits.

Capital One Credit Card features

- You will get a one-time $200 cash bonus after spending $500 on purchases within the first 3 months from account opening

- You will earn unlimited 3% cash back on dining, entertainment, popular streaming services, and at grocery stores, plus 1% on all other purchases excluding superstores like Walmart® and Target.

- Enjoy unlimited 5% cash back on hotels and rental cars booked through Capital One Travel, where you’ll get Capital One’s best prices on thousands of trip options.

- Get 8% cash back on Capital One Entertainment purchases and tickets at Vivid Seats.

- There are no rotating categories or sign-ups needed to earn cash rewards. Cashback won’t expire for the life of the account and there’s no limit to how much you can earn

- Pay 0% intro APR on purchases and balance transfers for 15 months; 15.24% – 25.24% variable APR after that

- Don’t need to pay any foreign transaction fee.

- No annual fee is needed to pay.

Capital One Credit card benefits

A new Capital One credit card will open up a world of endless exciting benefits and offers for you.

- Unlimited rewards with no expirations

- Earn Cashback on every purchase every day.

- Earn travel rewards on every purchase.

- Shop with your rewards at Amazon.com.

- Redeem rewards for gift cards with your favorite merchants.

- Easy Redemption options.

- Use your Capital One rewards on eligible purchases at millions of online stores.

- No foreign transaction fees.

- Get premier access to get more exciting benefits.

- 24/7 customer service.

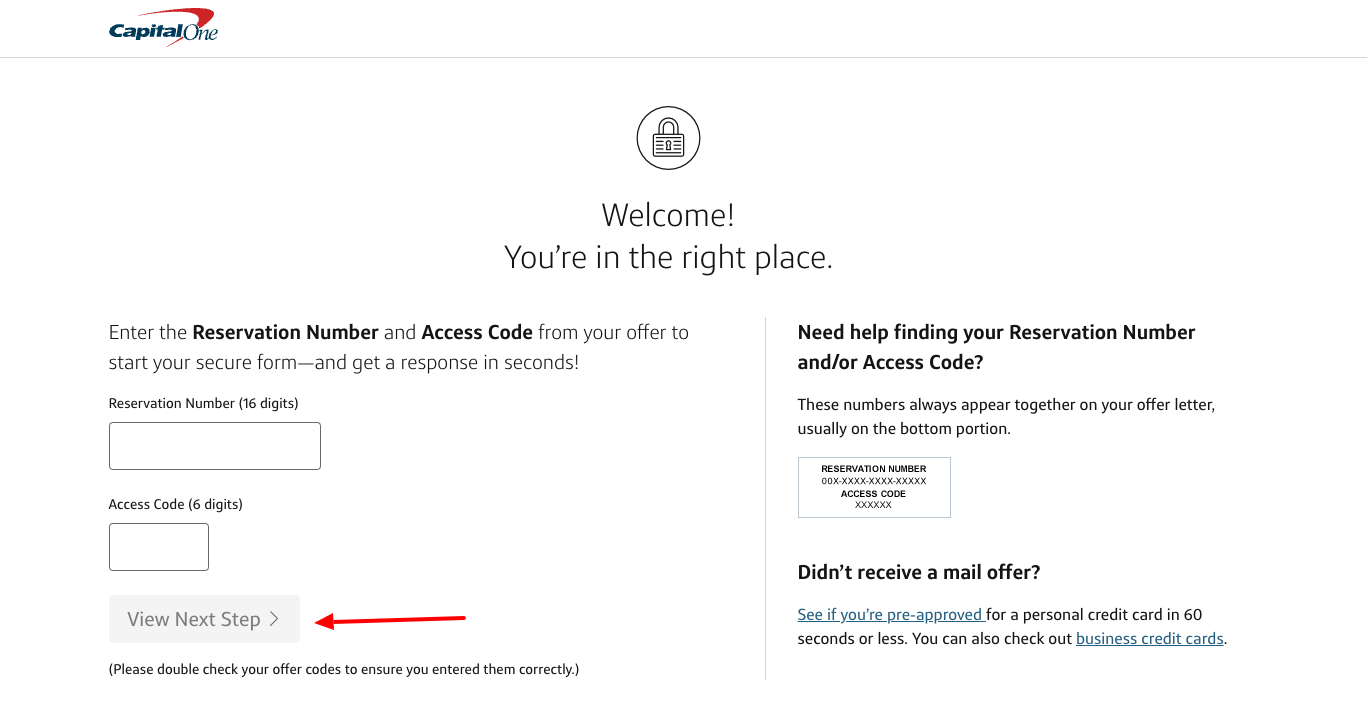

Capital One Get My Offer

- You will need to respond to a promotional credit card offer mailing from Capital One credit card.

- Capital One Financial Corporation manages GetMyOffer.CapitalOne.com

- You will need the Reservation Number and Access Code in order to start the application.

- Then click on View Next Step.

Features of Capital One Get My offer

- You must have a good credit score in need of a credit card

- Your minimum payment associated with Capital One credit cards will be the greater of $25 or 1% of the balance plus new interest and late payment fee

- These variable rates may change when the Prime Rate changes

Capital One credit cards

- Venture Rewards: This credit card requires excellent credit. You will get unlimited 2X miles per dollar on every purchase, every day.

- Quicksilver Rewards: This credit card requires excellent credit. You will get unlimited 1.5% cash back on every purchase, every day.

- Savor Dining Rewards: This credit card requires excellent credit. You will get a $150 cash bonus after spending $500 within the first 3 months of opening an account.

Capital One Credit Card Apply

Avail bigger cash signup bonuses, entertainment, and travel benefits then follow these simple steps to apply online.

- First, you have to visit the Capital One website www.capitalone.com.

- Then click on Apply now button under the card.

- On the next page fill up a form.

- Enter your details as directed.

- Submit your form.

Eligibility for Applying Capital One Credit card Get my offer

Applicants need to satisfy the following requirements by the bank to become successful Capital One Credit card holders.

- Proof of a US legal resident.

- The legal age of the applicants must be 18 years.

- You need to be employed and have a decent credit score.

Fees and Charges

- Different types of Capital One Credit Card have different fees. the interest rate can vary between 14.99% and 26.99%. but these charges are minimal compared to other card issuers in the United States.

- The annual fees of these cards include Savor Rewards ($95), Quicksilver One Rewards ($39), Spark Cash ($95), and Spark Miles ($95).

- If you will fail to settle the balance within the interest-free period then you have to pay an additional late fee of $39, on top of the unsettled amount and the interest rate.

Capital One Credit Card Activation

Online method

You will need to have an online account first if you choose to activate your card online. But if you don’t have any online account then first sign up with details required i.e., bank account details, social security number and date of birth. Once you get online access, follow these steps to activate your card.

- Firs,t visit the Capital One website www.capitalone.com.

- Then you have to log in with your user id and password.

- Then find your credit card.

- Provide the last three digits of the security code provided on the back of your card.

- Activate it.

By phone

If you want to activate your card by phone then follow these steps.

- Call at 800-227-4825

- You need to follow the instructions provided on call.

Also Read:

Bank of America Cash Pay Card Login

Through mobile app

You can activate your card through your mobile app. Follow these steps to activate.

- First, you have to download the Capital One mobile app.

- Login with the same information required to activate your Capital One online account.

- Click on your profile and then on account settings.

- Then you will see your new credit card.

- Click on Activate Credit card.

Capital One Credit Card Login

- First, visit the official website of Capital One card www.capitalone.com

- Then enter your username and password after that click on Sign In.

Capital One Credit card password recovery

You need to follow these simple steps in case you forgot your user’s name or password.

- Visit the official page of Capital One credit card verified.capitalone.com

- Click on the Sign In option.

- Below the sign-in option, you can find Forgot your user name or password link.

- Click on it.

- Provide all the basic information needed and click on the find me option.

- They will send you a mail confirming all your changes.

- Reset your password and get access to your account.

Capital One Credit card bill payment

Use the Capital One website or mobile app for making a capital one credit card payment. Set up payment notifications and manage your card. you can use the Capital One phone system or send a payment through the mail as an alternative.

Online bill payment

You’ll first need to set up online access and then log in through the site or app and set up a payment account like your savings or checking account.

- First, select the “Profile” option on the toolbar or app menu.

- Then tap “Settings” and look for an option to add a payment account.

- You’ll have to select the type of bank account.

- You have to fill in information including your routing number and account number.

- Then confirm you want to add the account.

- You can then simply select the credit card in the main account page.

- Then click the “Make a Payment” button.

- Then you will have to choose your payment account, desired payment date, and payment amount.

- Confirm to make the payment.

Payment through mail

If you want to use a check or money order, you can mail your payment in to Capital One. You have to Put your card number on the memo or note field of your money order or check so the company applies it to the right account.

Mail it to Capital One, Attn: Payment Processing, P.O. Box 71083, Charlotte, NC 28272-1083.

Call In payment

You can make a Capital One credit card payment by phone using a checking or savings account which requires calling 1-800-227-4825 to reach the cardholders’ services.

The system will prompt you to give the last four digits of the card you need to pay during call and will ask for the last four numbers of your Social Security number to check that you’re the right card member. Then you have to confirm the information, you’ll access a voice automated system that will tell you information about your accounts such as your payment due date and minimum payment.

Then tell the automated system you want to make a payment and follow the prompts to give a payment amount and date and provide the information for the account you want to use to make a payment. At the end of the call, you will get a payment confirmation number.

Lock your Capital One Credit card

You can instantly lock your credit card if lost or misplaced to prevent it from being used for purchases with just a few simple steps.

- Open your Capital One mobile app first.

- Log in and select the card you want to lock.

- Scroll down to the Need Help section.

- Click on the Lock card.

Customer Support

For general concerns, there is a 24/7 customer support hotline at 1877-383-4802.

For the credit card support hotline, call 1800-227-4825.

For online applications, you can also reach the bank at 1800-695-5500.

Capital One Financial Corp.,

1680 Capital One Drive,

McLean, VA, United States.

Capital One FAQs(Frequently Asked Questions)

- When will you receive your new credit card?

You will receive your Capital One card, credit limit information, and welcome materials by mail within approximately 7 to 10 business days. However, customers approved for a Secured Mastercard card will need to pay the deposit in full before the card ships—then it should be approximately 7 to 10 business days.

- How can you apply for your payments?

Your payments will be applied up to your minimum payment first to the balance with the lowest APR, and then to balances with higher APRs. They will apply any part of your payment exceeding your minimum payment to the balance with the highest APR, and then to balances with lower APRs.

- How can you report a lost or stolen card?

They will deactivate your old card so no one else can use it, and you can tell us if there are purchases on your account you didn’t make. If you can’t complete the process online, call 1-800-955-7070. If you are a small business customer, call 1-800-867-0904. From outside the United States, call our collect number at (804) 934–2001.

- Will Capital bank will charge a fee if you use your credit card overseas?

Capital One does not charge a fee for using your credit card for foreign currency transactions. Foreign purchases will be converted at the foreign exchange rate in effect at the time of processing the charge. Read more about the foreign transactions and currency conversion fees.

- How can you get a copy of your credit report?

You can get a free copy of your credit report once a year from each credit bureau shown above or at AnnualCreditReport.com.

Reference: