Sofi Personal Loan Application and Review

SoFi has been considered an online lending platform. This company offers unsecured personal loans in every state except Mississippi. You will get loans between $5,000 and $100,000 which are available for terms ranging from two to seven years. You will require a minimum credit score requirement of 650. As high-qualified applicants, you can score large loan amounts and the lowest interest rates. You can use these loans for personal, family, or household purposes, and borrowers typically receive funds within a few days of approval.

Sofi Personal Loan Requirements

- Applicants have good or excellent credit (690 FICO or higher).

- Candidates who are looking for a loan of at least $5,000.

- Who wants to apply for and manage a loan online?

- In case you want extra help with career and financial decisions.

Features of SoFi Personal Loan

- APRs of SoFi loans are low among lenders targeting good-credit borrowers.

- You don’t need to pay any

- You will get a rate discount for auto payment

- This loan needs a soft credit check to pre-qualify.

- SoFi reports on-time payments to three credit bureaus.

- Their rates, fees, and terms have been disclosed on the website.

- You will get direct payment to creditors with debt consolidation loans.

- This company provides loans within two to three business days.

- This is not available in Vermont.

- You will get two customer contact channels and seven-day support.

- Download a mobile app to manage loans.

- This company provides financial education and perks exclusive to members.

SoFi Personal Loan Pros

- You don’t need to pay any fees.

- Co-applicants are allowed in this company.

Cons of SoFi Loan

- You will need a relatively high minimum credit score requirement (650)

- Applications for loans over $20,000 take longer to process in this company

- Approval for your applications will take two weeks longer with a co-borrower

Promotional Offers for SoFi Loan

- You can apply for a fixed-rate loan ranging between 5.49% APR to 14.24% APR (with AutoPay)

- Ideal for those who are paying more than 9% interest on credit card debt.

- You can save thousands of dollars with SoFi loans.

How Can you Qualify for a SoFi Loan

- You must legally be an adult in your state.

- You will need to be a U.S. citizen, permanent resident, or visa holder.

- Applicants should be employed, have sufficient income, or have an offer of employment to start within the next 90 days.

Loan terms

- You will get SoFi loans for terms between two and seven years—or 24 and 84 months.

Loan amounts

- SoFi will provide you with unsecured personal loans from $5,000 to $100,000.

- Your minimum loan amounts will be higher in certain states—$10,001 in Arizona, Massachusetts, and New Hampshire, and $15,001 in Kentucky.

Cost of SoFi loans

- You will get APRs between 5.74% to 21.28% (with autopay).

- Your Maximum interest rates will be lower in several states: Alaska, Colorado, Connecticut, Hawaii, Illinois, Kansas, Maine, Oklahoma, South Carolina, Texas, Virginia and Wyoming.

- SoFi does not provide any origination fees.

- You will not be charged late fees—although late payments will result in higher interest accrual.

- This company will not impose prepayment penalties, so borrowers have the freedom to pay off their loans prior to the end of their loan term.

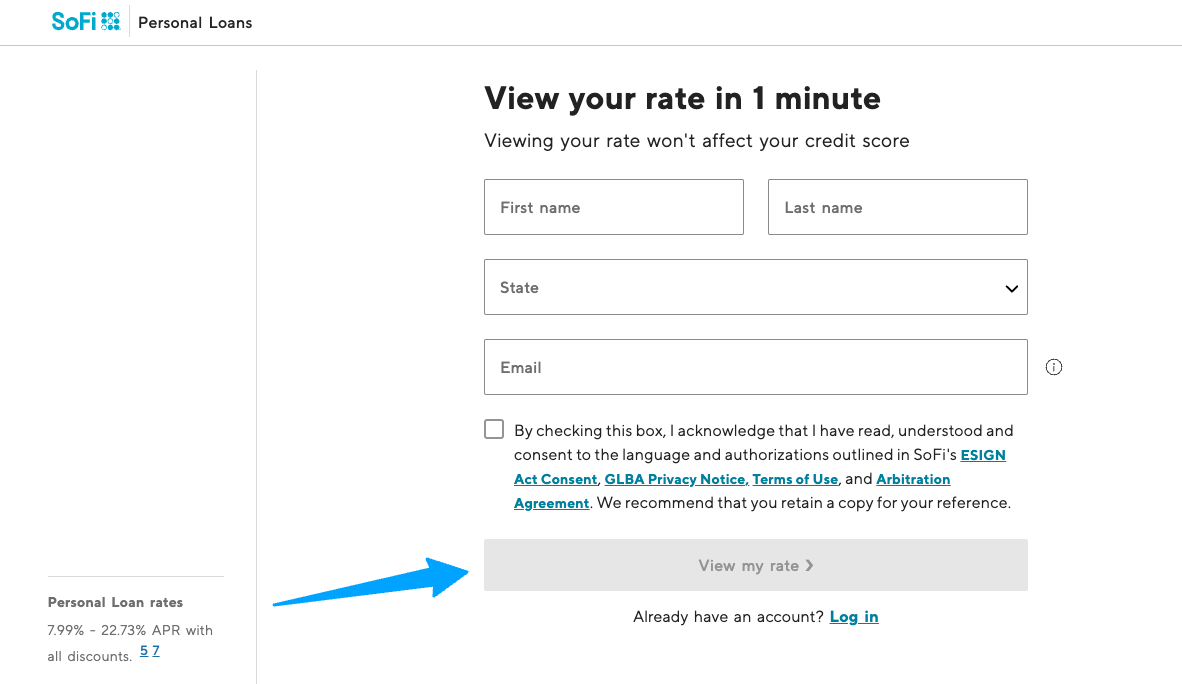

How to Apply for SoFi Personal Loan

If you want to apply for SoFi personal loan follow the steps below.

- Go to the sofi.com/personal-loans page

- Then click on the View your Rate button.

- Then enter your First name, Last name, and select State.

- After that click on the View my rate button.

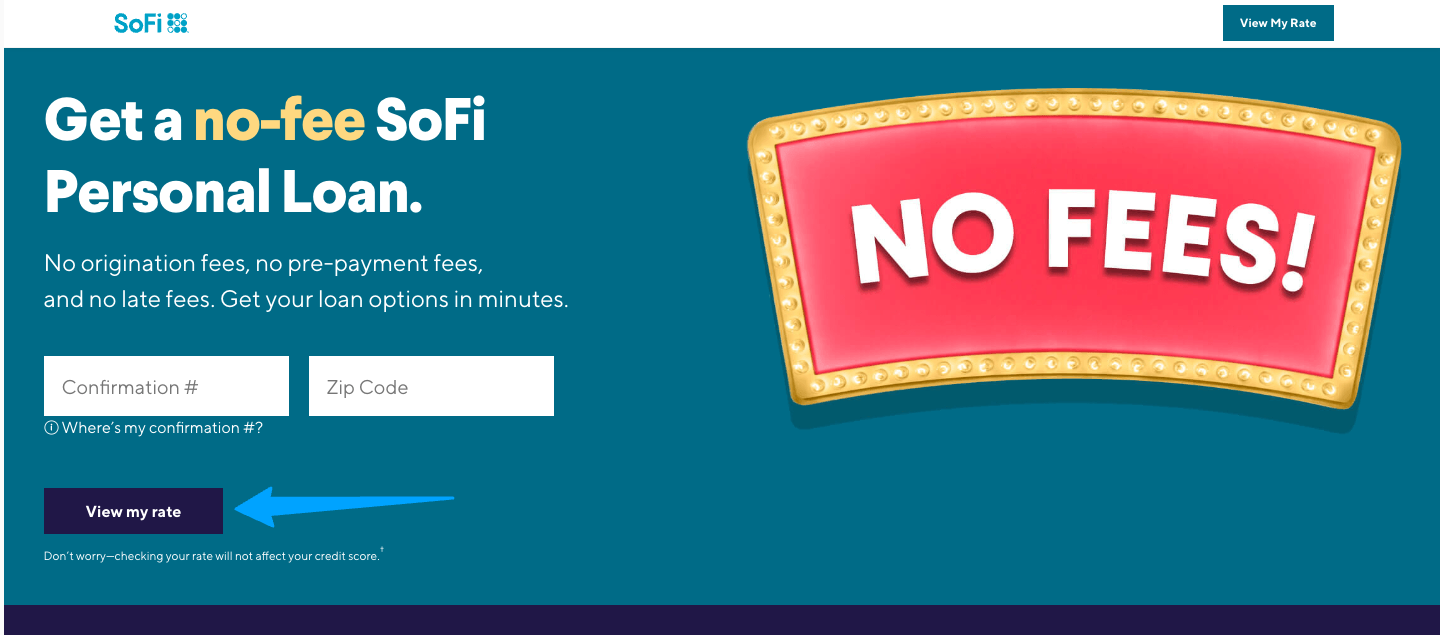

SoFi Special Loan Application Process

If you have any special confirmation email from the SoFi finance comnay, you can easily apply your loan through this. Just follow the steps below.

- Go to SoFiOffer.com link

- Then enter your 13-digit confirmation code and zip code.

- After that click on View my rate.

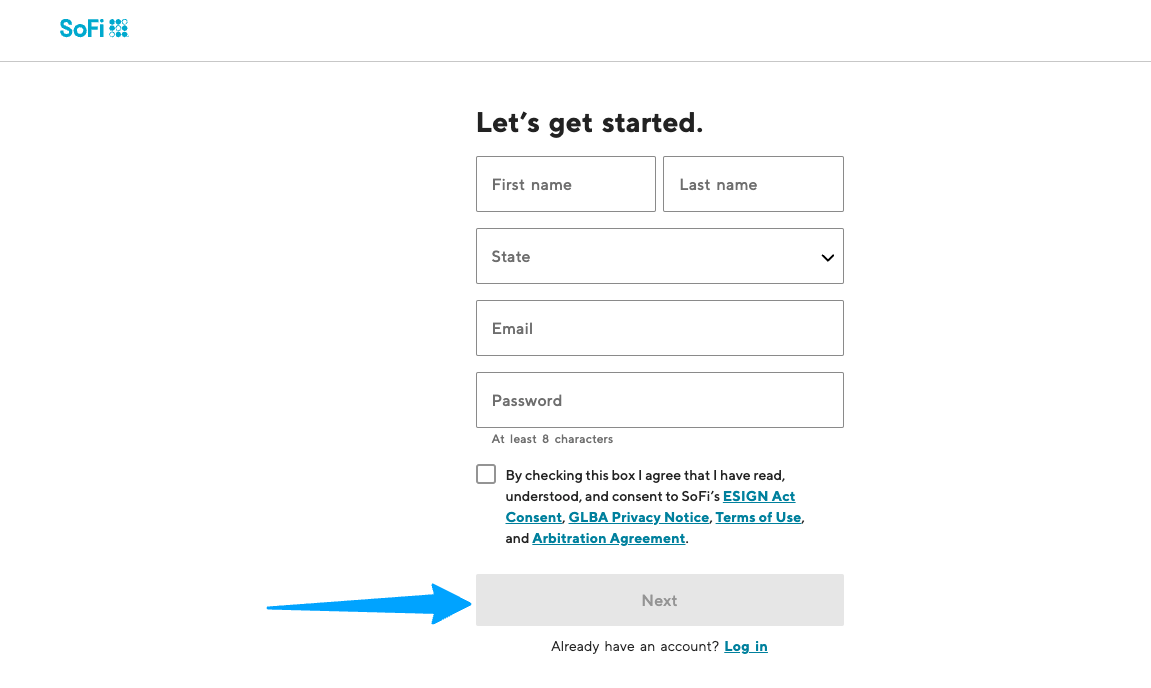

Create your SoFi Loan Login Account

If you don’t have a SoFi account, you can easily create it just follow the process and create your SoFi account.

- Directly go to the sofi.com/login page.

- Then click on the Create an Account button.

- Then enter your Firstname, Lastname, and select State, Password

- After that click on the Next bbutton.

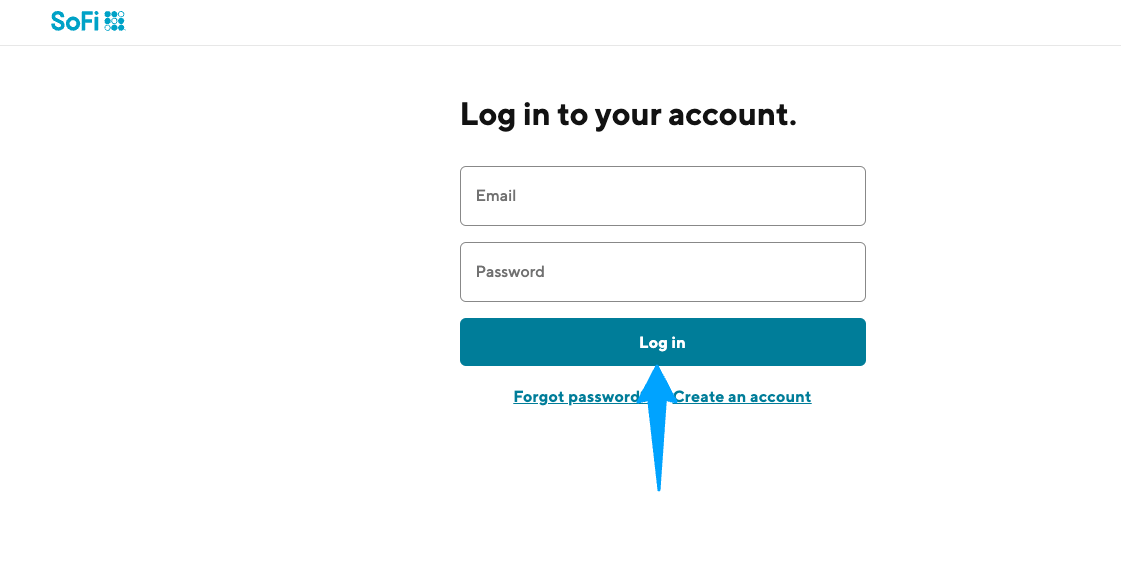

Access your SoFi Personal Loan Account

- Open the browser and go to the sofi.com/login link.

- Enter your Username and Password.

- After that click on Log in button.

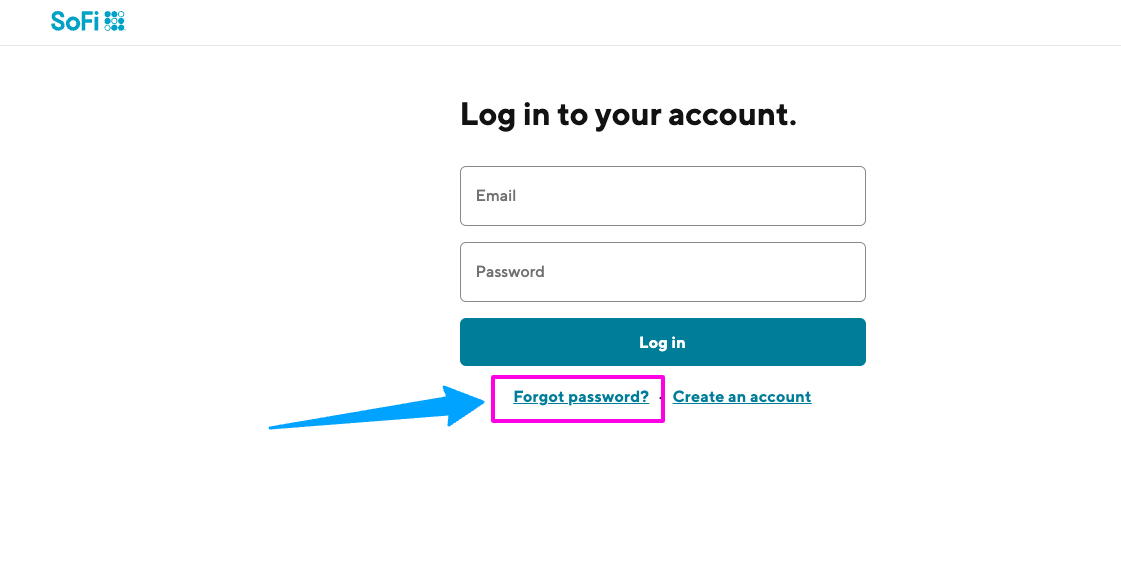

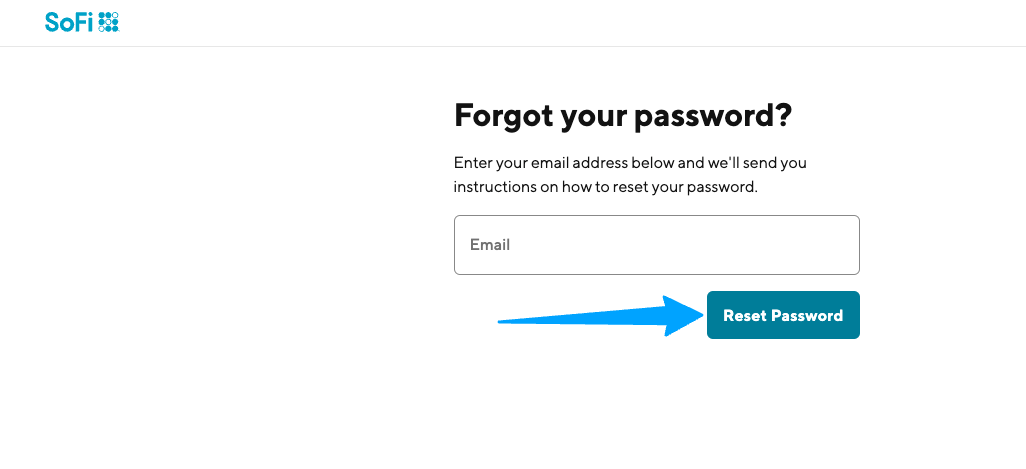

How to Reset SoFi Account Password

- Go to sofi.com/login link

- Then click on the ‘Forgot Password?’ link

- After that enter your email address.

- Then click on Reset Password button.

Also Read:

Town of Queen Creek Water Bill Pay

Purpose of SoFi loans

Permitted loans

- Credit card consolidation

- Relocation assistance

- Home improvements

- Medical procedures

Prohibited use

- Business purposes

- Investments

- Real estates

- Purchases of securities

- Post-secondary education

- Short-term bridge financing

Customer Support

For general concerns, there is the customer support which will help you 24 hours a day, 7 days a week.

Checking and Savings

Call at (855) 456-SOFI (7634)

Monday – Thursday 5 am-7 pm PT

Friday – Sunday 5 am-5 pm PT

Personal Loans

You can call at (855) 456-SOFI (7634)

Monday–Thursday 5 am–7 pm PT

Friday–Sunday 5 am–5 pm PT

Student Loan Refinancing & Private Student Loans

You can call at (855) 456-SOFI (7634)

Monday–Thursday 5 am–7 pm PT

Friday–Sunday 5 am–5 pm PT

Home Loans

You can call at (844) 763-4466

Monday – Friday 6am-6pm PT

Saturday – Sunday Closed

Invest

You can call at (855) 525-SOFI (7634)

Monday – Thursday 5am-5pm PT

Friday 5am-4pm PT

Saturday – Sunday Closed

Personal Loans

SoFi Lending Corp. or an affiliate Personal Loans

PO Box 654158

Dallas, TX 75265-4158

Home Loans

SoFi Lending Corp. or an affiliate

P.O. Box 11733

Newark, NJ 07101-4733

SoFi Lending Corp. or an affiliate

P.O. Box 54040

Los Angeles, CA 90054-0040

Student Loans

MOHELA

P.O. Box 1022

Chesterfield, MO 63006-1022

Invest (contributions via check)

Apex Clearing Corporation c/o Banking

350 N St Paul Street

Ste 1300

Dallas, TX 75201

SoFi Loan FAQs(Frequently Asked Questions)

Who can apply for a SoFi mortgage?

Applicants must be U.S. citizens, permanent residents, or non-permanent resident aliens and be the age of majority in their state of residence. SoFi also offers loans to certain non-permanent resident aliens on eligible visas. All applicants must reside in one of their eligible states. Moreover, mortgage eligibility also depends on a number of additional factors, such as credit scores, income, employment status, and property eligibility. Please review SoFi’s mortgage eligibility criteria for further details.

What is the minimum down payment SoFi will accept?

They may require as little as a 5% down payment for well-qualified applicants. The maximum loan amount and program requirements apply.

Can you refinance an existing mortgage?

Yes, qualified applicants may apply for refinancing. In some cases, the minimum equity required is 5%.

Do you require private mortgage insurance (PMI)?

For mortgages with a Loan to Value ratio greater than 80%, SoFi does require BPMI (Borrower Paid Mortgage Insurance).

What is the difference between a pre-qualification and a pre-approval?

A pre-qualification is an estimate of how much you can borrow and the rates you may be eligible for (as determined using today’s rates), based on a preliminary review of your credit report and the information you provided to them. With SoFi, there is no fee to get pre-qualified and we do a soft credit pull, which means it won’t affect your credit score.

A pre-approval is a more formal offer, based on a complete credit check, and evaluation of your employment history, income, and assets. A pre-approval allows you to submit an offer with confidence that you are personally approved for a loan. Once you have identified a property to purchase, it must meet SoFi property eligibility standards.

Does SoFi require a property appraisal?

Yes, for the majority of transactions a property appraisal is required with the exception of those that are eligible for a Fannie Mae Property Inspection Waiver.

What is your rate lock policy?

SoFi may grant requests for a 45-day rate lock after receipt of a signed purchase contract or a fully completed refinance application. Please note that mortgage rates may change on a daily basis.

Reference