www.mrcooper.com/signin – Payment guide for Mr. Cooper Bill Online

Mr. Cooper Bill Pay:

At Mr. Cooper, they trust in keeping the fantasy of homeownership alive. So whether you’re selling a home, purchasing a home, or getting comfortable to the home you love, they’re here to make your homeownership venture not so much troubling but rather more remunerating each progression of the way.

When it comes to claiming your home, they accept the more you know, the less you need to stress over. Any house can be a fantasy home. Here and there it takes a couple of attempts. That is the reason we’re continually concocting better approaches to make purchasing and selling a home not so much troubling but rather more fulfilling.

Features of Mr. Cooper:

- Full computerized admittance to your home loan. Whenever, anyplace.

- Point by point intel on your home estimation and value.

- Grant winning versatile application that causes you to find better approaches to achieve your objectives.

- 100% U.S. based home counsel group to help make you a specialist on your home credit.

Mr. Cooper Online Bill Pay:

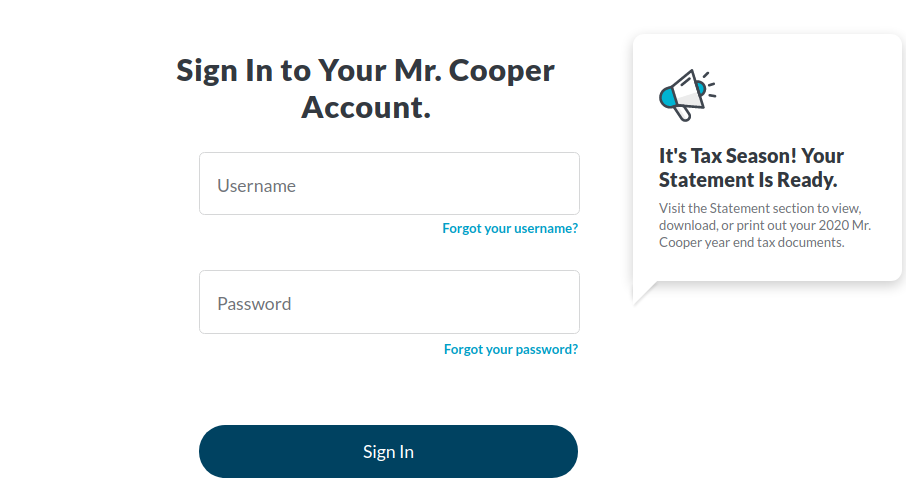

- To pay the bill online open the page www.mrcooper.com/signin

- As the page opens at the center you have to provide information such as

- Username, password click on ‘Sign in’ button.

Recover Mr. Cooper Login Information:

- To recover the login information open the page www.mrcooper.com/signin

- After the page opens in the login homepage click on the ‘Forgot username?’ button.

- In the next screen provide loan number, last four numbers SSN, property zip code, check the verification box. Hit on ‘Find my username’ button.

- For password recovery enter your username, check the verification box click on ‘Send email’ button.

Create Mr. Cooper Account:

- For the account registration open the page www.mrcooper.com/signin

- As the page opens at the center click on ‘Create an account’ button.

- In the next screen provide loan number, SSN, property zip code, check the verification box click on ‘Find loan’ button.

Also Read : How to pay Carefirst Blue Cross Blue Shield Bill Online

Mr. Cooper Bill One Time Payment:

- For an one-time payment open the page www.mrcooper.com/support

- As the page opens click on Payment methods’ button.

- In the next screen at the center click on ‘One time payment here’ button.

- You will be forwarded to the next screen you will be asked to login with the online account.

- You have to proceed with the login prompts.

Mr. Cooper Bill AutoPay:

- You can set up automated payment and for this you have to login to your account.

- You have to open the page, www.mrcooper.com/support

- As the page opens login to your account set the payment.

Mr. Cooper Bill Pay by Phone:

- You must have the payment details and pay the bill through phone number.

- You have to call on, 888-480-2432. Fees up to $14 is applicable

- You have to follow the automated prompts.

- If you are looking for live payment call on 888-480-2432. $19 fees is applicable.

Mr. Cooper Bill Pay by Mail:

- You can pay the bill by mail. You have to send the check to a certain address.

- Send it to, PO Box 650783. Dallas, TX 75265-0783.

Mr. Cooper Bill Other Payment Options:

- You can pay through Western Union or Money Gram.

- For Western Union you can call on 800-325-6000. Or check their website. You need this code: MRCOOPER. State: TX.

- For Money Gram call on 800-926-9400. The code is 1678.

Mr. Cooper Bill Pay off:

- You pay off the bill in two methods.

- By Mail: You can send the payment to Lake Vista 4. 800 State Highway 121 Bypass. Lewisville, TX 75067.

- By Phone: To make the pay off by phone call on 888-480-2432.

Mr. Cooper Loan Features:

- Fixed-Rate: A fixed-rate home advance is a credit with a loan fee that never shows signs of change. A well-known term for fixed-rate credits is 30 years, however, numerous banks offer other term choices. Fixed-rate credits with more limited terms will in general require higher regularly scheduled installments, the however less absolute premium paid over the life of the advance.

- Movable Rate: With a movable rate contract, your rate may change dependent on public rate files. Customizable rate home advances have an underlying fixed-rate period after which the rate will change at expressed periods. For instance, a 5/1 ARM is a credit with a fixed rate for a very long time, at that point one yearly change for the remainder of the advance term. Every change has yearly and lifetime limits.

- Standard mortgage: A standard mortgage isn’t guaranteed by the government. They ordinarily require at least five percent down and have both fixed or movable rate alternatives. Mainstream typical mortgage terms are 15 and 30-year. The most extreme credit sum for standard mortgages is $510,400.

Mr. Cooper Contact Information:

For more information call on 888-480-2432.

Reference Link: